Cryptocurrencies are probably here to stay. True, prices once again tumbled yesterday after the U.S. SEC sued the major crypto exchange  Binance is threatening to freeze its U.S. assets. But fundamentally, these are still global markets with huge daily turnover.

Binance is threatening to freeze its U.S. assets. But fundamentally, these are still global markets with huge daily turnover.

However, with the mining exit of the second largest currency Ethereum, cryptocurrencies are no longer dependent on graphics cards, which has eased the GPU market significantly over the past 12 months. Previously, current graphics cards were almost permanently sold out worldwide and could only be purchased at prices far above the recommended retail price. Most recently, the threat of recession due to strong inflation and weak demand had a relaxing effect on the market, which caused prices for IT products as a whole to plummet for the last few quarters.

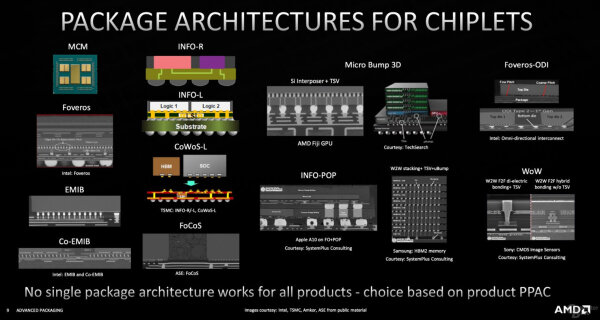

But as various sources are now reporting, it could soon be over again with the acceptable GPU prices. Although the chip factories currently still have enough capacity to meet an increasing demand, the assembly of dies into finished microchips is a problem. With classic processors, packaging was not particularly complex, but modern designs now require a great deal of additional effort for bonding, stacking or special processes to attach dies to interposers and pass their contacts through.

TSMC can no longer handle this complex further processing of the chips (the so-called "advanced packaging") on a large scale on its own. There are other competitors like ASE, but they also have nicely overfilled order books until 2024.

The demand for Nvidia's AI server chips (and the extreme profit margins that can be achieved there), which was just triggered by ChatGPT, is now allegedly causing Nvidia to want to use its packaging capacities primarily for its AI server chips. And will throttle graphics card production accordingly for the next few quarters. Which, in turn, will likely drive up prices for popular models. Or could drive users into AMD's arms. However, we can only guess whether AMD's optioned capacities are also tightly calculated. In any case, there are voices that say that there is not too much leeway here either.

So, should the economy and IT demand pick up again in the third quarter - as currently predicted - then the prices for graphics cards (and for complex processors) should at least move in sync again.